Data Highlights

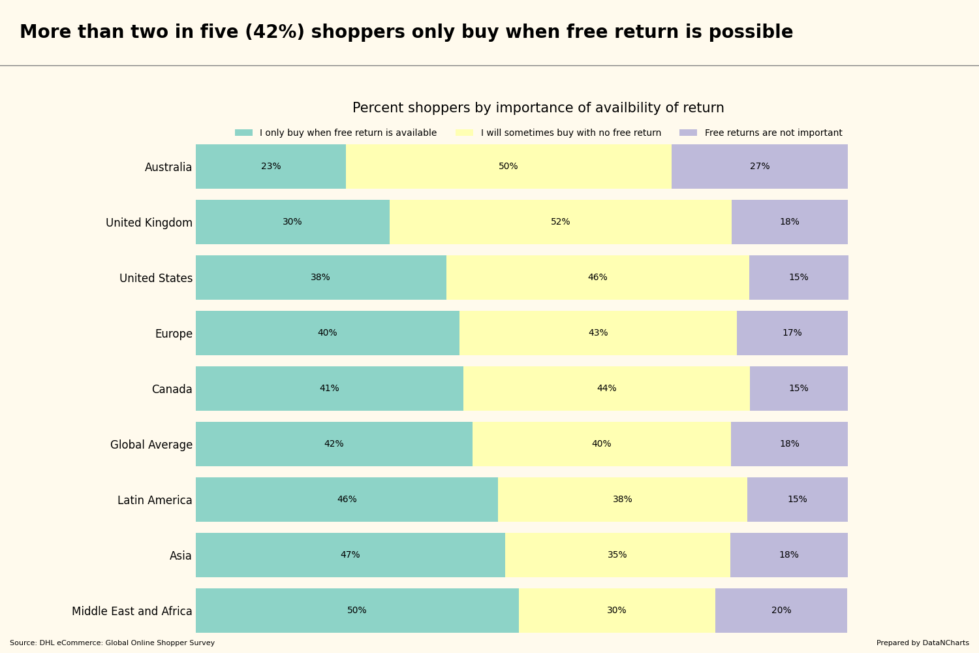

Almost half of shoppers in the Middle East and Africa (49.5%) only buy when free returns are available.

Close to half of shoppers in Latin America (46.3%) prefer free returns when making purchases.

Shoppers in the United Kingdom are more flexible, with 52.5% sometimes buying without free returns.

Australia has the highest percentage (27%) of shoppers who say free returns are not important.

The United States has a significant portion (46.5%) of shoppers who sometimes buy without free returns.

In Canada, 41% of shoppers only buy when free returns are offered.

Nearly one-third of shoppers in Asia (47.4%) will only buy with free returns.

Europe shows a balanced view, with 42.6% sometimes buying without free returns.

The global average indicates that 42.4% of shoppers only buy when free returns are available.

Scope

Return policies can impact a shopper’s decision to buy online. Offering free returns is a major factor, but how important is it across different regions? This insight brief explores the role of free returns in the global shopping landscape. The data highlights how much shoppers in various regions value free return options when making online purchases. Understanding these preferences can help e-commerce brands tailor their strategies to meet customer expectations.

Importance of Free Returns in the Middle East and Africa

The data shows that shoppers in the Middle East and Africa are most influenced by free returns. Nearly half of shoppers (49.5%) in the region only purchase if free returns are available. This indicates that free returns are a key driver in gaining consumer trust and driving sales in this region. Understanding this can help brands make smart decisions about where and how to offer return policies.

As we look beyond the Middle East and Africa, Latin America follows a similar trend, but with some differences.

Latin American Shoppers Are Strongly Influenced by Free Returns

In Latin America, 46.3% of shoppers also show a strong preference for buying only when free returns are available. This suggests that while the region is somewhat flexible, brands can gain a competitive edge by offering hassle-free returns. Consumers in this region still appreciate free return policies, but there is also room for flexibility.

Looking to another region, Canada has a somewhat different pattern.

Canadian Shoppers Show Flexibility in Return Preferences

Canada demonstrates a mix of preferences. About 41% of Canadian shoppers only buy when free returns are offered, but nearly the same amount (44%) will sometimes purchase without it. This signals a more flexible approach, where return policies matter but do not solely drive purchase decisions. Brands here can focus on educating shoppers about both flexible return policies and product quality to build trust.

Moving westward, Europe offers yet another variation in shopper behavior.

European Shoppers: A Balanced Approach

European shoppers take a balanced view. 40.4% only buy with free returns, while 42.6% will sometimes buy without it. This middle-ground approach gives brands the opportunity to appeal to both segments. A well-thought-out return policy can influence hesitant buyers, while others may respond to other factors like convenience or product features.

Heading south, Australia presents an interesting deviation.

Australia’s Buyers Value Flexibility

Australia has the highest percentage of shoppers (27%) who say free returns are not important. Here, half of the shoppers will buy without free returns, showing a strong sense of flexibility. Brands should focus on other value propositions, such as price or unique product offerings, to capture this market’s attention.

In contrast, the United Kingdom reveals a different insight into the shopping mindset.

United Kingdom: Flexibility Leads the Way

The United Kingdom stands out, with 52.5% of shoppers willing to buy even if free returns are not available. Only 29.7% insist on free returns. Brands selling in this market should focus on highlighting product quality, shipping speed, or other perks beyond return policies to capture interest.

The United States offers another interesting comparison, emphasizing the need for strategic planning.

United States: A Mix of Preferences

In the United States, 38.4% of shoppers only purchase with free returns, while 46.5% will sometimes buy without them. This mix of preferences shows that, while important, free returns are not the only factor in purchasing decisions. Offering free returns can help build trust, but brands should also focus on convenience and product offerings to appeal to a broader audience.

Insights and Opportunities

The data reveals how free return policies influence shopper behavior across the globe. E-commerce and retail brands should tailor their return policies to match regional preferences. In regions like the Middle East, Africa, and Latin America, free returns are essential. Prioritizing this offering in these areas will help attract more customers. In more flexible regions like Australia and the United Kingdom, brands can focus less on returns and more on product value or delivery speed.

When creating content or ads, brands should highlight the benefits of their return policies in regions where shoppers value them most. In regions that are more flexible, brands should focus their content on other aspects of the shopping experience, such as discounts, unique product features, or fast shipping options.

To guide consumers toward purchase, brands should emphasize hassle-free returns where they are highly valued. For markets that don’t prioritize returns, focusing on customer satisfaction, reliable product descriptions, and reviews will help bridge the gap and lead shoppers to complete their purchases. Understanding these regional differences will allow brands to fine-tune their strategies and connect more effectively with their target audience.