Data Highlights

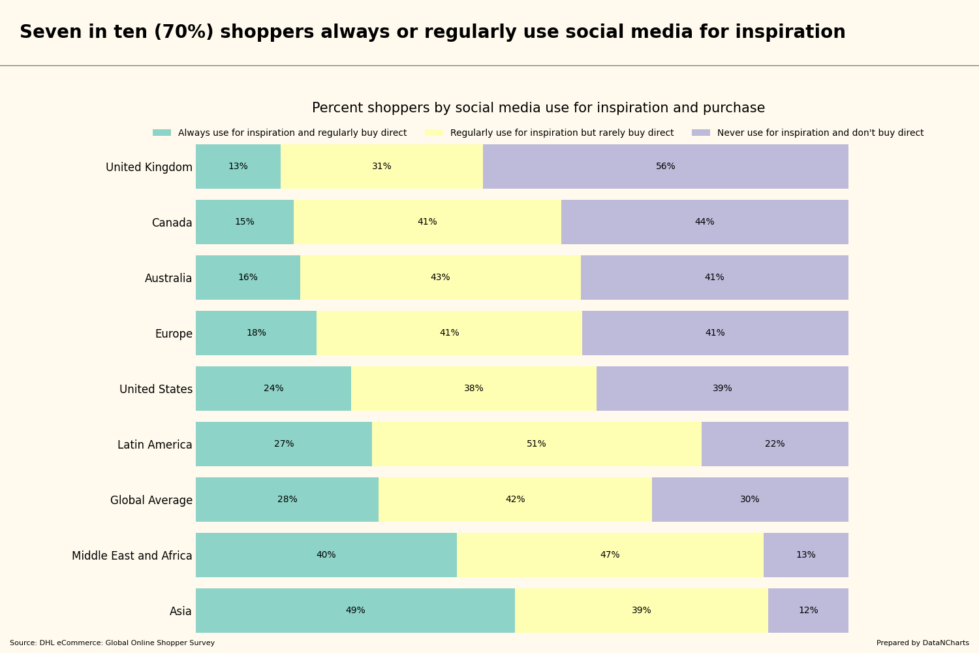

Nearly half of shoppers in Asia (48.9%) always use social media for inspiration and buy directly.

Almost half of shoppers in the Middle East and Africa (47%) regularly use social media for inspiration but rarely buy direct.

Latin America has the highest percentage (50.5%) of shoppers who use social media for inspiration but rarely purchase directly.

A majority of shoppers in the United Kingdom (56%) never use social media for inspiration and do not buy direct.

Nearly half of Canadian shoppers (44%) never use social media for inspiration or purchasing.

Shoppers in Australia show a balanced split across all three categories, with 43% regularly using social media for inspiration but rarely buying direct.

The global average for shoppers who regularly use social media for inspiration but rarely buy direct is about 42%.

Over a quarter of shoppers globally (28%) always use social media for inspiration and purchase directly.

Scope

In today’s digital age, social media influences how people discover new products and shop. Consumers use platforms to find inspiration, but their behavior varies across regions. Some buy directly, while others browse without making a purchase. Understanding these patterns helps brands and retailers better target their audiences. This insight brief explores global trends in social media usage for shopping inspiration and purchasing.

Global Differences in Social Media Usage

Social media use for shopping inspiration differs by region. In Asia, almost half of shoppers (48.9%) always use it for both inspiration and purchasing. This is the highest of all regions. These consumers feel comfortable exploring products and buying them directly. It highlights the trust Asian shoppers have in social media as a reliable source for both inspiration and direct purchasing.

Next, let’s see how a different region behaves when it comes to browsing but not buying.

High Inspiration, Low Purchasing in Latin America

In Latin America, over half of shoppers (50.5%) regularly use social media for inspiration but rarely buy directly. This group seeks ideas, engages with content, and discovers trends, but hesitates when it comes to clicking “buy.” For businesses, this means the region presents a strong opportunity to turn browsers into buyers by bridging this gap.

Now, let’s look at regions where social media doesn’t play as big of a role in shopping behavior.

The United Kingdom Shuns Social Media for Shopping

Shoppers in the United Kingdom show the lowest engagement with social media for both inspiration and purchasing. More than half (56%) don’t use social platforms to find products and don’t buy directly. This shows brands need different strategies to engage this audience, such as focusing on other marketing channels.

While the U.K. shows low social media engagement, Canada reveals another interesting trend.

A Balanced Picture in Canada

Canada presents a more even distribution. Nearly equal groups of shoppers use social media for inspiration and purchasing, with 41% rarely buying and 44% not using it at all for these purposes. This balanced behavior suggests that Canadian shoppers are cautious in their social media shopping habits, and retailers should consider a multi-channel approach to engage them.

After understanding Canada’s balanced picture, let’s explore how global averages compare.

Global Trends Reflect Varied Behavior

Globally, a little over a quarter of shoppers (28%) always use social media for both inspiration and purchasing. However, a larger group (42%) regularly finds inspiration but doesn’t often buy directly. These figures suggest that, worldwide, many people rely on social platforms for discovery, but a significant portion remains reluctant to make purchases through these platforms.

Now that we’ve seen how regions vary, let’s conclude by exploring what businesses can do with this data.

Insights and Opportunities

These findings offer several key takeaways for e-commerce, retailers, and consumer brands. First, brands need to know where social media plays a strong role in driving inspiration and purchase behavior. In regions like Asia, brands can focus on boosting the buying experience on social platforms, using features like shoppable posts and seamless checkouts.

Second, content and creative strategies should cater to each region’s behaviors. In Latin America, businesses need to create content that encourages the next step—buying. This means offering clear calls to action, limited-time deals, and more confidence-building measures like customer reviews and testimonials.

Lastly, guiding customers to purchase can be achieved by making the buying process easier. If many shoppers are inspired but not purchasing, simplifying the checkout process and offering incentives like free shipping or easy returns could be the nudge they need to convert. Combining these approaches will help brands better engage shoppers and turn inspiration into action.