Data Highlights

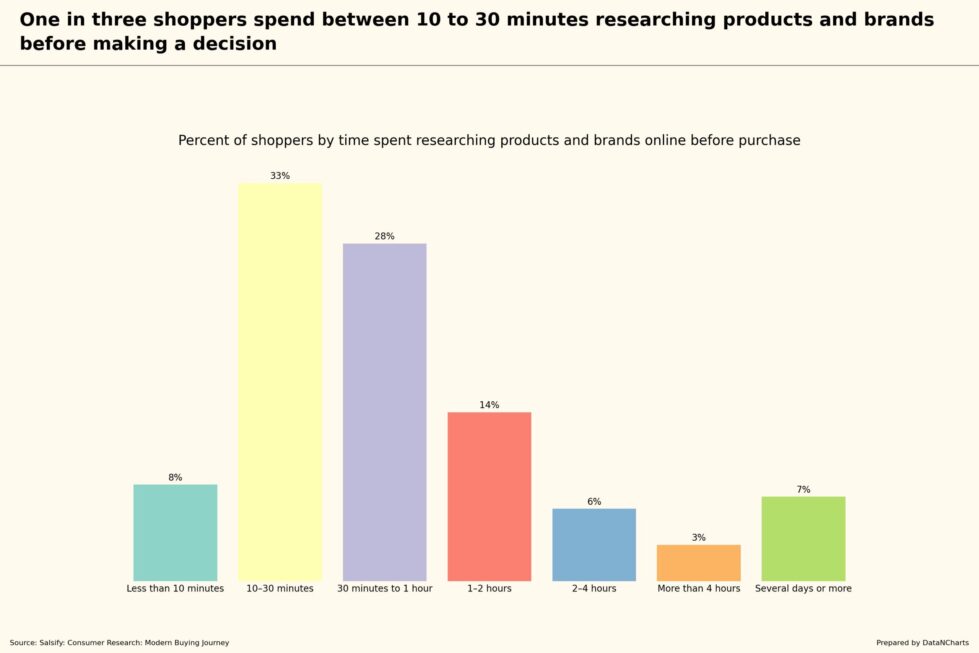

One-third (33%) spend between 10 and 30 minutes researching.

Nearly three in ten (28%) research between 30 minutes and one hour.

About one in seven (14%) spend between 1 and 2 hours researching.

A negligible share spending less than 10 minutes (8%). Similarly less than one in ten spend two to four hours (6%), four hours or more (3%) or even several days or longer (7%) researching products.

Scope

Understanding shopper research duration helps brands refine their shopper journey analysis. Rising e-commerce trends show consumers seek quicker decisions. Inflation pushes shoppers to spend less time choosing, making fast and clear content crucial. Readers will gain clear consumer behavior insights to optimize shopper marketing strategies, timing, and content.

Most Shoppers Make Decisions Within an Hour (61%)

Nearly two-thirds (61%) of shoppers spend under one hour researching products. Quick, effective decisions dominate consumer purchase patterns. Brands must clearly present content that simplifies decision-making. Clearly structured product pages and concise descriptions significantly influence quicker purchases.

Yet, some shoppers commit slightly more time.

Moderate Research: One to Two Hours (14%)

About one in seven (14%) shoppers spend between one and two hours researching. These shoppers seek deeper insights into product quality, reviews, and alternatives. Retailers must clearly provide detailed product information and clear comparisons. Effective use of purchase intent keywords helps influence consumer choices within this timeframe.

Still, fewer shoppers extend their research extensively.

Extended Research Remains Limited (2–4 hours: 6%, Over 4 hours: 3%)

A negligible share (6%) spends two to four hours researching, with even fewer (3%) extending beyond four hours. These shoppers carefully consider high-value purchases, examining multiple options. Brands clearly supporting detailed consumer decision-making gain shopper trust and influence final choices.

Meanwhile, some shoppers prefer extended research periods.

Multi-Day Research Journeys (7%)

A negligible share (7%) researches products over several days or more. Typically, shoppers considering expensive or complex products spend extended time gathering information. Clearly offering educational resources and detailed comparisons supports these extended customer journey mapping processes, building trust and eventual sales.

However, many shoppers decide faster.

Minimal Research: Less than 10 Minutes (8%)

A negligible share (8%) of shoppers decide within ten minutes. These quick-decision shoppers clearly respond best to concise, compelling content emphasizing clear pricing, immediate availability, and strong ratings. Retailers must ensure fast, simple content delivery to convert these buyers.

Insights and Opportunities

Shopper research times clearly reveal opportunities for targeted retail strategies, content optimization, and effective shopper marketing.

- Firstly, brands must provide concise content optimized for quick research. Retailers creating clearly presented product pages, highlighting immediate benefits and urgency, see increased conversions from fast-deciding shoppers. Retailers implementing these approaches can expect improved conversion rates, shorter shopper journey times, and increased customer satisfaction. Measure success by tracking conversion rates, bounce rates, and session durations.

- Secondly, support moderate research with detailed product insights and comparisons. Clearly presented product details and accurate customer reviews build shopper trust, increasing likelihood of purchase. Brands can expect reduced returns, higher satisfaction, and increased repeat purchases. KPIs include reduced product returns, increased customer ratings, and improved repeat purchase frequency.

- Finally, brands should clearly provide comprehensive content supporting longer shopper journeys. Offering detailed guides, comparisons, and buyer education effectively attracts careful shoppers evaluating big-ticket items. Retailers implementing this strategy clearly improve customer confidence, strengthen brand authority, and boost high-value sales conversions. Track success with KPIs including increased average order value, reduced customer uncertainty, and improved sales conversion on premium products.

Clearly understanding research times allows brands to strategically guide shoppers through their shopper path to purchase, improving customer experience optimization and overall business performance.