Data Highlights

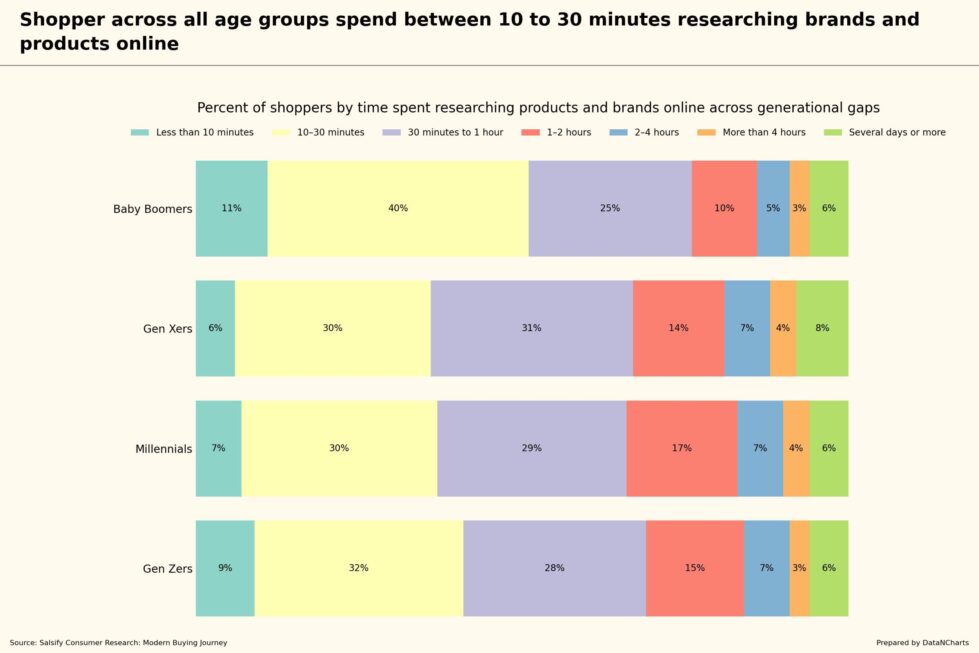

About four in ten (40%) Baby Boomers spend between 10–30 minutes researching products.

Nearly one-third of Gen Xers (31%) and Gen Zers (28%) spend 30 minutes to one hour researching products.

Millennials split evenly between short research (30% spend 10–30 minutes) and moderate research (28% spend 30 minutes to one hour).

A negligible share from all generations spends less than 10 minutes: Baby Boomers (11%), Millennials (6%), Gen Xers (6%), Gen Zers (8%).

A negligible share spends longer periods: several days or more (Gen Xers at 8%, others around 6–8%) or more than four hours (3–4%).

Scope

Shoppers now spend less time making purchase decisions. Inflation and busy lifestyles accelerate consumer decisions. Retailers must clearly understand research behaviors to align content effectively. This brief examines generational differences in research durations, helping brands refine shopper journey analysis and shopper marketing strategies.

Baby Boomers Prefer Quick Decisions (40% in 10–30 minutes)

Baby Boomers value quick shopping decisions, with four in ten (40%) spending only 10–30 minutes researching. Retailers clearly targeting this generation must provide straightforward product information quickly. Concise descriptions, pricing clarity, and straightforward navigation support this rapid consumer decision-making process.

While Baby Boomers prefer speed, younger shoppers often require slightly more time.

Gen Xers and Gen Zers Favor Moderate Research (31%, 28%)

Gen Xers (31%) and Gen Zers (28%) prefer spending between 30 minutes to one hour researching. These generations value deeper consumer behavior insights like ratings, product comparisons, and detailed reviews. Brands clearly providing accessible, trustworthy product content effectively guide Gen X and Gen Z toward purchase.

Millennials balance quick and moderate research habits, highlighting their mixed preferences.

Millennials Balance Quick and Moderate Research (10–30 min: 30%, 30 mins–1 hr: 28%)

Millennials equally prefer short (30%) and moderate (28%) research durations. Clearly presented, detailed product information meets millennial expectations and simplifies their shopper path to purchase. Retailers aligning content clearly to these consumer behavior insights influence millennials effectively.

While most shoppers decide quickly, a minority across generations take significantly longer.

Negligible Share Conduct Extensive Research Across All Generations (Less than 10%)

A negligible share across generations researches extensively, either several days (6–8%) or more than four hours (3–4%). These shoppers invest more time considering high-value purchases. Retailers must clearly present in-depth content to reassure these cautious buyers, improving digital consumer engagement and shopper experience design.

Insights and Opportunities

Generational differences in shopper research clearly highlight actionable opportunities for e-commerce and retail brands to optimize strategies.

- Firstly, clearly tailor content to quick-decision shoppers like Baby Boomers. Fast, simple content presentation reduces decision times, increases conversions, and boosts sales. Brands can expect shorter shopper journeys, increased customer satisfaction, and reduced abandoned carts. KPIs include session duration, conversion rates, and customer satisfaction scores.

- Secondly, clearly support moderate research preferences of Gen X and Gen Z. Providing clear comparisons, customer reviews, and detailed product insights improves shopper confidence. Brands will experience lower product returns, increased customer loyalty, and higher conversion rates. Measure success through product return rates, repeat purchase frequency, and product page engagement rates.

- Finally, retailers must clearly provide comprehensive information for shoppers conducting extended research. In-depth product content, clear comparisons, and detailed explanations guide these buyers effectively. Brands adopting this approach will see increased trust, higher average order values, and improved conversion rates on high-value items. Track key performance indicators like increased conversion rates for premium products, reduced customer uncertainty, and improved satisfaction ratings.

Aligning strategies to generational research behaviors allows brands to guide consumers effectively through their shopper journey, enhancing overall customer experience optimization and retail performance.