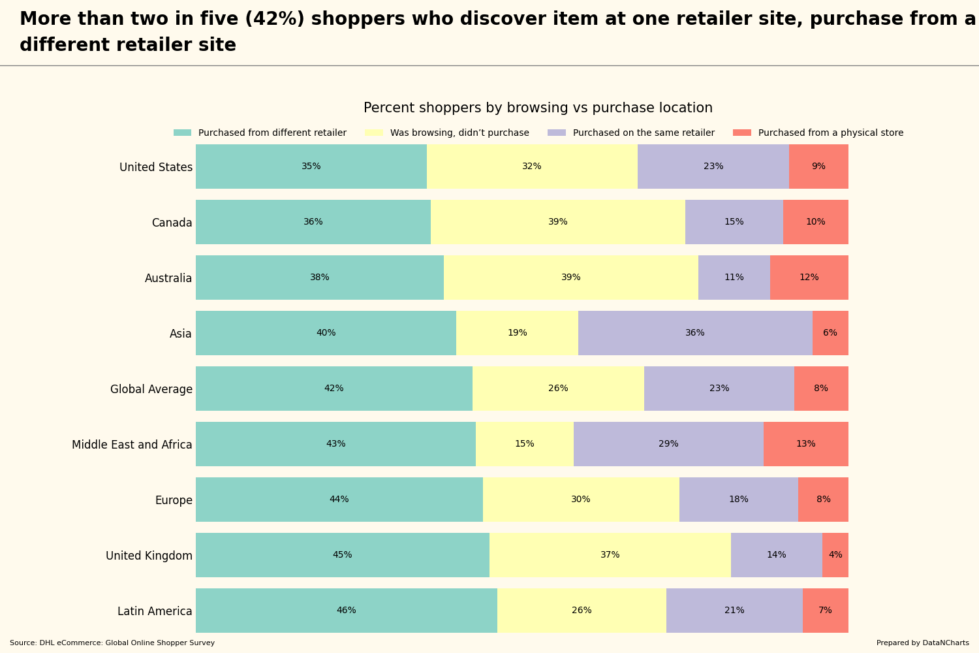

Data Highlights

Nearly half of shoppers in Latin America purchased from a different retailer (46.2%).

Shoppers in Europe are more likely to browse without buying (30.1%).

Only a small portion of shoppers in Asia made purchases at physical stores (5.5%).

Australia and Canada have the highest percentage of shoppers who browse but don’t purchase (both 39%).

The Middle East and Africa saw 42.9% of shoppers switch to a different retailer after browsing.

Shoppers in the United Kingdom showed a high tendency to buy from a different retailer (45%).

The United States has a slightly lower rate of retailer switching compared to the global average (35.4% vs. 42.4%).

On average, 8.3% of shoppers globally made purchases at physical stores.

Scope

Shoppers are constantly making decisions about where and how to buy. Many browse online and in-store but end up purchasing from places different from where they first looked. This insight brief breaks down how shopper behavior varies across regions and what this means for retailers. Understanding these patterns can help businesses optimize their strategies to drive purchases and improve customer experiences.

Shoppers in Latin America Lead in Switching Retailers

In Latin America, nearly half of shoppers (46.2%) purchased from a different retailer than the one they first browsed. This makes Latin America the region where shoppers are most likely to switch. Understanding why these shoppers shift can offer retailers valuable insight into improving customer retention.

But it’s not just Latin America where this trend is strong. Other regions show significant numbers of shoppers changing retailers after browsing.

High Retailer Switching in the United Kingdom and Europe

Following Latin America, the United Kingdom and Europe see large portions of shoppers switching retailers. Forty-five percent of UK shoppers and 44% of European shoppers chose different retailers than the ones they initially browsed. This behavior shows that browsing isn’t always enough to secure a sale. Retailers must work harder to convert interest into purchases.

Despite this, not all shoppers switch retailers. In some regions, shoppers are more likely to complete purchases from the same retailer.

Steady Conversion Rates in Asia and the United States

While regions like the UK and Latin America show high retailer switching, Asia and the United States have steadier conversion rates. In Asia, 35.9% of shoppers stayed with the same retailer after browsing. The U.S. saw a similar trend, with 23.2% purchasing from the same retailer.

This stability suggests opportunities for retailers in these regions to build loyalty and keep shoppers from looking elsewhere. However, browsing patterns without purchase also reveal important insights.

High Browsing Without Purchasing in Australia and Canada

In Australia and Canada, browsing often does not lead to purchases. Around 39% of shoppers in both regions browse but do not make a purchase. This trend hints at the importance of improving engagement strategies to close the gap between browsing and buying.

Even though online shopping is dominant, some shoppers still prefer the traditional experience of purchasing from a physical store.

Physical Store Purchases Remain Low

Across all regions, purchases from physical stores remain low. The global average shows only 8.3% of shoppers made purchases in-store. This is even more noticeable in regions like Asia, where only 5.5% bought from physical stores. This data underscores the continued dominance of e-commerce and the need for retailers to adapt to this shift.

Insights and Opportunities

The data highlights clear trends in how shoppers behave across regions. For e-commerce, retailers, and consumer brands, the first step is to recognize that a large percentage of shoppers are not committed to the first retailer they browse. To capture these shoppers, businesses need to strengthen their digital engagement and improve their customer journey.

- When generating content and ad creatives, businesses should target shoppers who are prone to browsing but not purchasing.

- Creative and personalized experiences can drive more conversions.

- Brands can also learn from high-switching regions by offering incentives and targeted promotions to encourage loyalty.

To guide shoppers toward purchase, retailers should offer seamless, well-designed websites that make it easy to go from browsing to buying. Personalized recommendations, clear pricing, and quick checkout processes will help reduce the chance of shoppers looking elsewhere. Additionally, it’s crucial to keep mobile shopping experiences smooth, as more customers are using mobile devices for their purchases.

By acting on these insights, businesses can better understand their customers and create strategies that resonate with today’s global shoppers.