Data Highlights

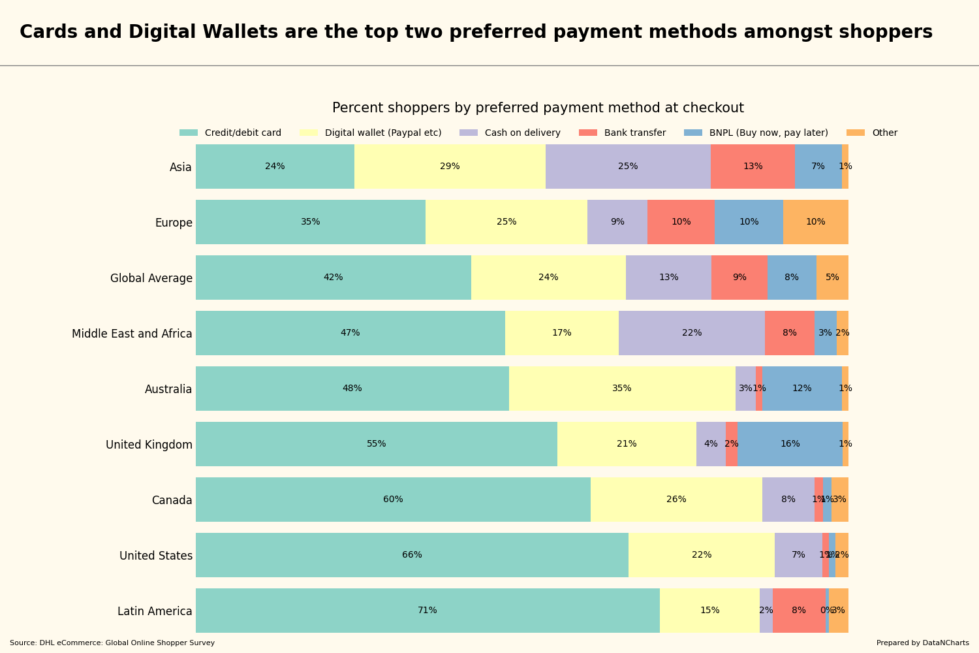

Almost three-quarters of Latin American shoppers (71.1%) prefer credit/debit card payments.

Over one-third of shoppers in Australia (34.7%) favor digital wallets like PayPal.

In Asia, about one-fourth of shoppers use cash on delivery (25.3%).

Around one-eighth of shoppers in Europe (10.5%) use buy now, pay later (BNPL) services.

Less than 1% of shoppers in Australia use cash on delivery (3.1%).

The United States has one of the highest credit/debit card usage rates, with about two-thirds of shoppers (66.3%) choosing this method.

Canada has one of the lowest buy now, pay later usage rates (1.3%).

Roughly one in five shoppers in the Middle East and Africa (22.4%) prefer cash on delivery.

The global average for bank transfer payments is just under 9% (8.6%).

Scope

Understanding how consumers prefer to pay for their online purchases is key to succeeding in e-commerce. Payment preferences vary by region, and businesses need to adapt to stay relevant. In this insight brief, we will explore the different payment methods shoppers use across major global regions and identify the opportunities for businesses to cater to these preferences.

Credit/Debit Cards Dominate in Latin America

Credit and debit cards are the most preferred payment method in Latin America. About three-quarters of shoppers (71.1%) in the region rely on this option at checkout. This shows how ingrained card payments are in this market. Other regions, like the United States (66.3%) and Canada (60.5%), also show strong preference for cards, but Latin America leads.

As we move forward, we will see how digital wallets are becoming a key player in many regions.

Digital Wallets Gain Ground in Australia and Asia

Following the dominance of credit cards in Latin America, digital wallets like PayPal are making strides in Australia and Asia. In Australia, just over one-third of shoppers (34.7%) prefer digital wallets, while in Asia, the number is close (29.3%). The convenience and security of digital wallets are driving this trend, especially in countries where mobile payments are common.

This shift towards digital wallets creates opportunities for growth in payment innovation. Let’s now consider how cash on delivery remains strong in some regions.

Cash on Delivery Still Popular in Asia and the Middle East

While digital wallets rise in popularity, cash on delivery remains a trusted method for many. In Asia, about one-quarter of shoppers (25.3%) prefer paying this way, and in the Middle East and Africa, this number stands at 22.4%. This shows how cash payments continue to hold importance in regions where digital infrastructure may not be fully developed.

As we explore further, we'll see how buy now, pay later services are gaining traction in specific regions.

Buy Now, Pay Later Services Surge in the UK and Europe

The rise of buy now, pay later (BNPL) services is most noticeable in Europe and the United Kingdom. In Europe, roughly one in ten shoppers (10.5%) use BNPL, while in the UK, the number reaches 16.1%. This method appeals to consumers who want flexibility in their payments. Retailers that offer BNPL can attract more shoppers, especially younger ones seeking alternative payment options.

Let’s wrap up by looking at the trends and what businesses can do to adapt.

Insights and Opportunities

The data shows how diverse payment preferences are across the world. To succeed, businesses need to adapt to these trends. Here are three actionable insights for e-commerce, retailers, and consumer brands:

- Reaching Your Target Audience

Businesses should offer multiple payment methods to cater to local preferences. For example, offering both credit card and cash on delivery options in regions like Latin America and Asia can broaden your customer base. - Creating Content and Ads That Resonate

Tailor your ad campaigns to highlight the preferred payment options for each region. For instance, showcasing digital wallet promotions in Australia or BNPL services in the UK could resonate better with your audience. - Guiding Customers to Purchase

Simplify the checkout process by prioritizing the most popular payment methods for each region. In Latin America, make credit card payments smooth and quick. In the Middle East, offer clear cash on delivery options with easy steps to complete the purchase.

By leveraging these insights, businesses can better connect with their target audience, create relevant content, and boost conversion rates through optimized payment experiences.